Keeping accurate records is a necessity, as is making sure you’re getting paid properly and on time for client projects. Luckily, there is an increasing number of accounting apps on the market and many of them will work well for WordPress developers.

But there are also some things to look out for. Picking the wrong accounting app can cause real headaches. It’s much easier to make the right choice the first time around.

So, if you have a few minutes, grab yourself a cup of strong coffee and let’s spend some time talking about how to pick the most appropriate accounting app for your WordPress development business.

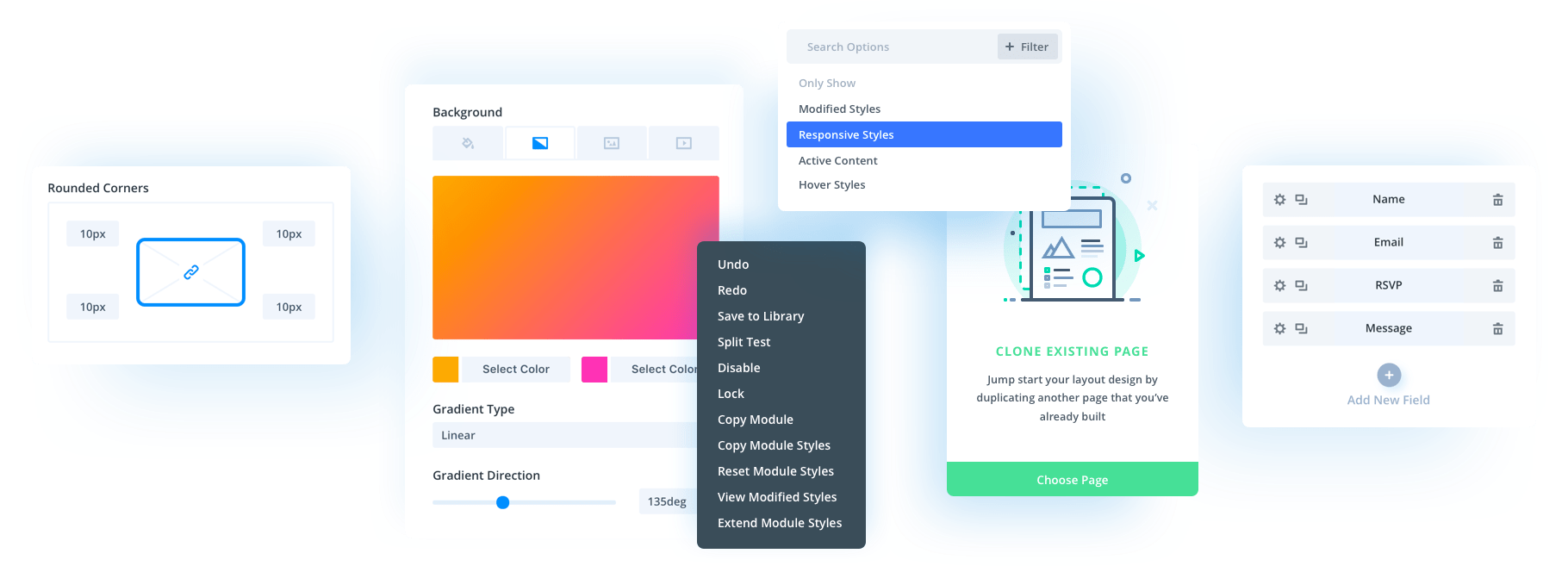

Not All Accounting Apps Are Created Equal

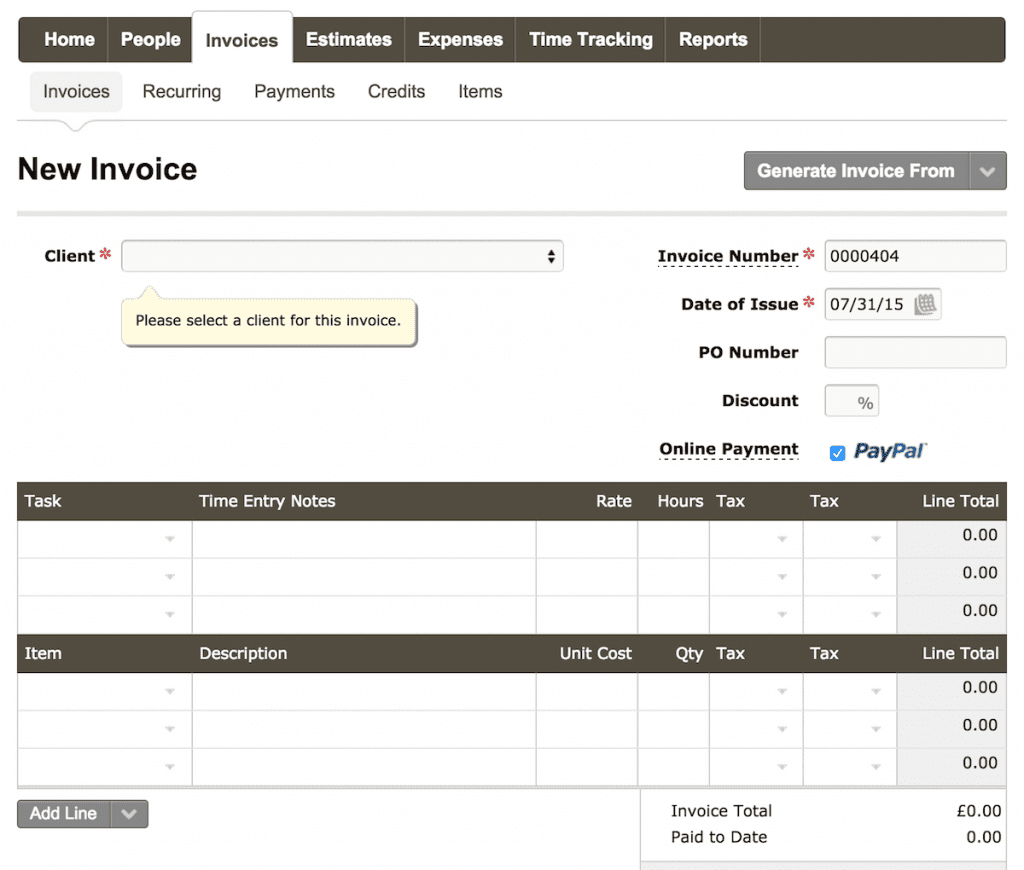

FreshBooks’ invoicing screen

The companies creating most of the popular apps have caught onto our disdain for all things accounting. To counteract our attitudes, they’ve worked hard to create user interfaces that are visually appealing and apps that are efficient – automating or speeding up the most time-consuming tasks.

For the most part, they have been successful in their attempts. Keeping on top of your books is not the chore it once was. Invoicing takes but a few clicks, reminders are automated, and bank reconciliation no longer takes an entire Saturday afternoon.

When picking an accounting app, it’s important that you are not drawn in by a flashy user interface or features that seem oversimplified. Not every accounting app comes with the same features, and there are even a few that should probably drop the “accounting” moniker altogether.

WordPress development may not be complicated from an accounting perspective, but there are a few features that I think are critical. While no app is perfect, some provide a more robust feature-set than others.

Accounting Features Important to Developers

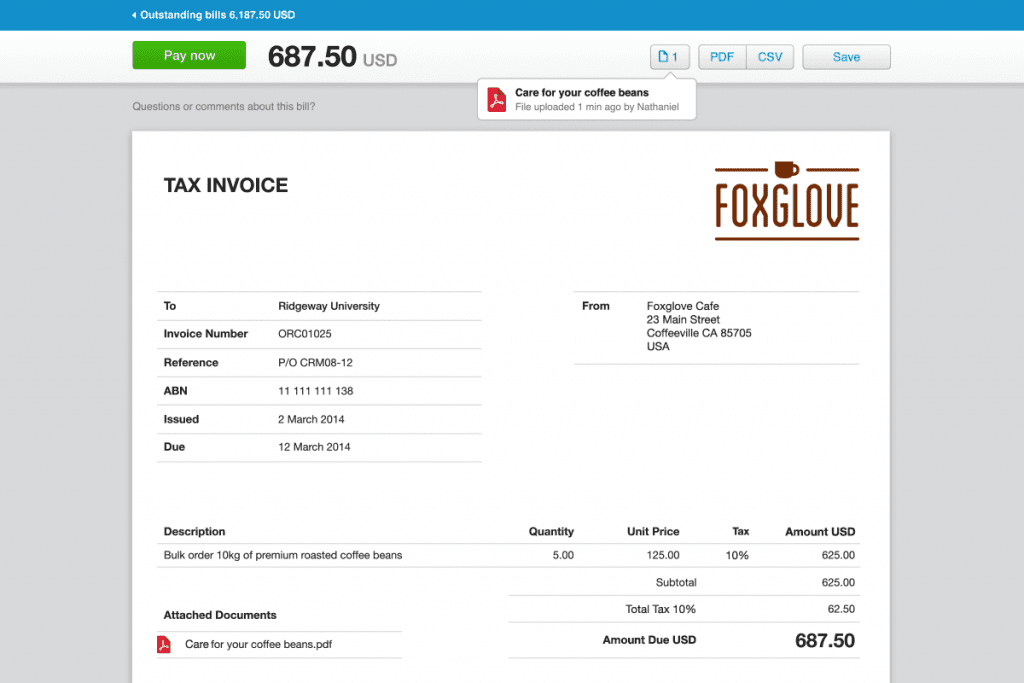

Xero’s invoices

Chances are, as a WordPress developer you’re running a remote business. Although if you’ve built yourself a small agency, you might be sharing a physical space. Maybe you have employees or maybe you rely on contractors.

All these variations are the reason there is no such thing as the perfect accounting solution for every developer. Your needs will vary and they are also likely to change over time. When you’re trying to pick out an accounting app, think a few years down the road – anticipate your future needs.

Here are a list of features you might want to consider as important:

Online Accounting is a relative must. Most – if not all – online accounting software offers security and encryption that’s as good as what you get at your local bank. If you are also working with an accountant or bookkeeper, it’s incredibly convenient to be able to share access if and when required.

A Mobile App may not be critical, but it sure makes life convenient. Being able to enter expenses on the go and snap a picture of a receipt makes life less complicated. And when you find yourself having to kill some time, it’s nice to be able to catch up on your invoicing.

Quotes are an essential part of business for most WordPress developers. Being able to create a quote for a prospective client and then turn it into an invoice with a few clicks is a huge time saver.

Invoicing is a must-have feature, but you’ll be surprised to discover that not all accounting apps treat invoicing with the same degree of importance. An extremely simple and well-rounded invoicing process is at the core of what makes FreshBooks so popular. It just goes to show what a headache developers and freelancers around the globe consider invoicing to be.

Payments are another part of accounting that has become increasingly simplified, thanks to online payment processors. All four of the options discussed below offer the ability to accept online payments through third-party payment processors or have an in-house option. Gone are the days of “the check is in the mail”.

Paying Bills and keeping track of expenses are a must-have feature. Make sure that if you have many bills to enter each month, the process is efficient. For example, just recently FreshBooks automated the expense categorization process. Prior to June 2015, it was a real headache to manage this process manually.

Bank Reconciliation was once the worst part of accounting. Spending all day reconciling your bank account only to find that you’re a few cents out could be heartbreaking. Thankfully, most accounting apps have simplified the process, but make sure you do your homework if this is an important feature for you.

Multi-Currency accounting has become increasingly important in today’s global economy. Having to convert multiple currencies at the end of the year can be a real headache. If you receive payments from clients around the globe, this is a feature worth paying for.

Reporting is a pretty standard feature in all accounting apps these days. The ability to take a quick snapshot of your financial picture is convenient, and access to real-time reports make it easy to keep up to date with the health of your business.

Payroll. While two of the apps (Xero and QuickBooks) discussed below have some basic payroll features included, in most cases you’ll require the use of a third-party integrated service. For a lot of developers, payroll won’t be a critical feature so we won’t discuss it in too much detail here.

Four Top Accounting Apps

After considering which features are most important to your development business, you’ll be in a better position to pick the appropriate accounting app. Spending a little extra time researching is worth the effort, because nothing is worse than entering all your data into an app only to discover it’s missing a feature that you really need.

Many apps can be integrated. For example, Freshbooks invoices can be automatically imported into Xero (you’ll understand why you’d consider doing this in a moment) using third party apps like Zapier. The problem with this approach is that although it increases functionality, it also increases your monthly expenditure.

One exception to this might be if you contract out your bookkeeping to a third party. If that’s the case, they’ll able to export data from your app into whichever accounting program they’re using and balance your books from there.

FreshBooks

FreshBooks bills itself as a cloud accounting app and it has a lot of positive features that work in its favor. The software (mobile app included) is incredibly easy to use and is constantly improving. In addition, FreshBooks’ invoicing capability is awesome and they offer multiple payment gateways including PayPal, Stripe, Authorize.net and direct credit card.

However, with all of its great features, Freshbooks is missing one key ingredient in that it’s not a true accounting app. With no ability to reconcile your bank account, you are left having to export your data to another program like QuickBooks or Xero. While this isn’t necessarily a deal breaker, it does mean you’ll be paying for two separate programs.

Key Features:

- Pricing starts at $19.95/month for up to 25 clients.

- Extensive invoicing capabilities.

- Multi-currency invoicing.

- Expense tracking and receipt storage.

- Very easy for clients to pay invoices.

- Easy to use time-tracking.

Harvest

Harvest advertises itself as “simple online time tracking software”, which is a mild understatement because it also offers full invoicing and expenses tracking. But, similar to FreshBooks, Harvest’s strength lies in the time tracking and invoicing since it’s not a true accounting app.

If you’re running a small agency and require additional staff accounts, Harvest seems the cheaper way to go, offering up to five users at the $49 price point. Compare this to Freshbooks, at $39/month with one additional user, plus $10 for each additional.

Even with the great time-tracking features and easy invoicing, you’ll still be left wanting if you require more robust accounting features.

Key Features

- Solo pricing starts at $12/month.

- Easy and effective time tracking.

- Invoicing with three online payment gateways.

- Simplified project management.

- Integrates with both Quickbooks and Xero.

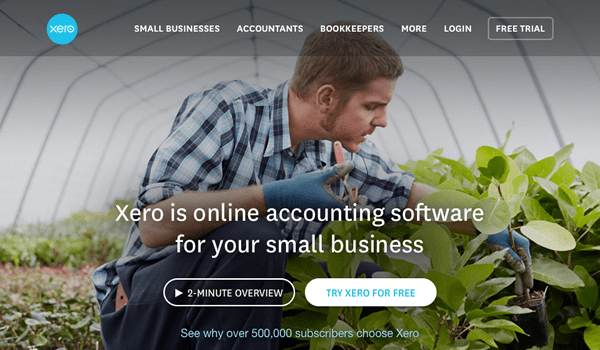

XERO

Xero claims to have “beautiful accounting software”. Can accounting software be beautiful? That’s for you to decide but for the most part, Xero does present a simple, easy to use and highly functional interface. Plus, Xero is what you can consider a full-featured accounting app.

Where Xero falls just short is in their invoicing capabilities. Yes, with just a few clicks you’ll be able to send an attractive invoice to clients and have them pay via your chosen gateway. The only step missing is to automatically record that payment in Xero, which saves you from having to make a manual entry. A small detail, I know. The invoicing is good enough in Xero that I would have a hard time justifying the use of a separate invoicing app.

Although it’s slightly more expensive with a full-featured plan starting at $30/month, it might be a small price to pay for unlimited users and the ability to perform a full bank reconciliation. One thing to note is that if you want multi-currency accounting, you’ll need to upgrade to the premium plan that costs $40/month.

Key Features

- True full-featured accounting and automatic bank reconciliation.

- Manage multiple bank accounts.

- Simple quotes and invoicing with multiple payment gateways.

- Create recurring invoices and payments.

- Simple payroll features and advanced integration options.

- Great support.

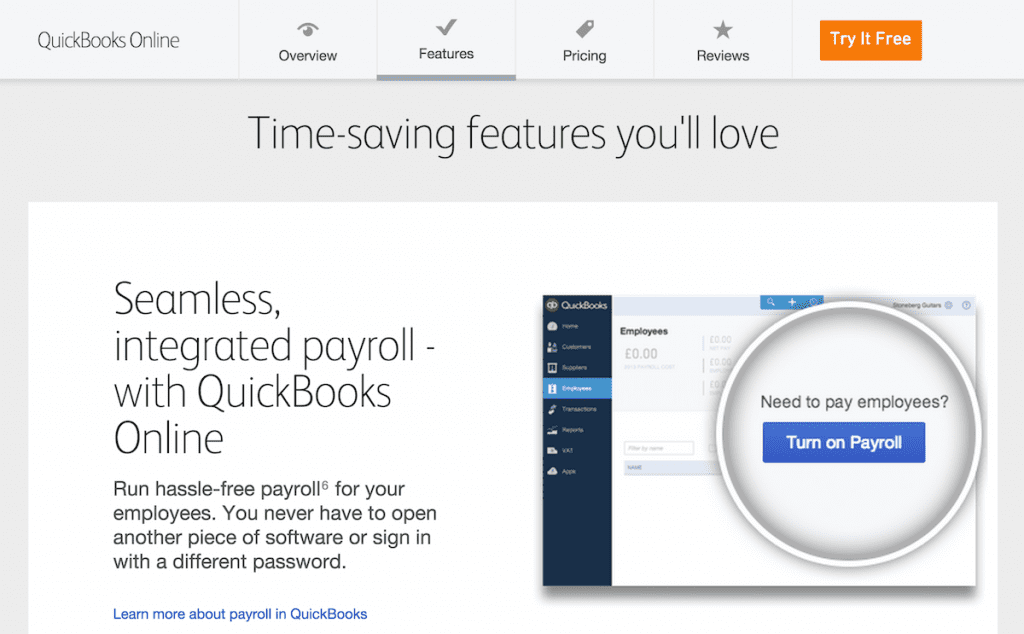

QuickBooks Online

Intuit QuickBooks has made the transition from desktop software (still available) to SaaS. Being the second of our four options to provide full-service accounting, QuickBooks online has been around for a long time. They offer competitive pricing that starts at $39.95/month for features comparable to Xero.

One drawback to QuickBooks is that if you allow clients to pay their invoices via a “pay now” button, you’ll have to rely on QuickBooks’ in-house payment processing. Not a huge issue, as their rates per transaction are competitive, but still, it would be nice if Intuit gave you an alternative option.

Key Features

- Manage revenue and expenses.

- Create quotes and invoices (including recurring).

- Time-tracking.

- Accept online payments (through Quickbooks).

- Multi-currency accounting.

Conclusion

Depending upon your specific requirements, any one of the apps that we’ve listed in this post will work well for developers, designers or small agencies. If you rely heavily on invoicing with time tracking capabilities, FreshBooks or Harvest are probably your best bets. Just be prepared to pay for a separate app capable of managing your bank account(s) as well. Alternatively, be prepared to hand off your invoice and expense information to a bookkeeper who can match your records with your bank statement.

If you’re looking for a full-featured accounting app with good – but not quite amazing – invoicing, consider Xero or QuickBooks Online. Because of the ability to choose a payment processor and add additional users as required, I’d probably give a slight edge to Xero.

There are many lesser known accounting apps available that we haven’t covered here.

If you’ve tried one of the apps discussed or if you’ve got another accounting app that you’re in love with, please share in the comments below!

Image Credit: Sentavio / Shutterstock.com

Great insight! I’m inspired while reading this blog! It entails a lot of things regarding accounting. It’s true that we need those accounting app for us to have an accurate data. Thank you very much!

I would also recommend Clever Accounting which is what I use. Invoicing and managing customer credit is easy, it has multi-currency capabilities, and you can also manage your expenses. The support is great too. Starts at just $13.50 / month, or free for startups.

I think that Pancakeapp should definitely be on this list! I have been using it for a few years already now, it is in constant development and seems to be getting better and better.

I use FreshBooks and love it. I tried Wave waveapps.com before discovering FB and thought it was great too… I guess I like the UI with FB more.

I’ve been using waveapps for the last six months! I like it 🙂

I have been using Zoho Invoice for the last year or so and it fits my needs well. With good timekeeping that is easily integrated into an invoice as well as recurring invoicing, PayPal integration and unlimited clients, it’s a great fit for me at $15/ mo.

Pros:

timekeeping

PayPal integration

Recurring invoices

Billable and non-billable expenses

Good reporting

Cons:

Doesn’t round the timekeeping in 1/4 he increments which would be helpful

Timekeeper isn’t front and center – have to click back to it often.

Overall, a good fit to include in this list for freelance web designers / developers.

Yeah, good point Tom Ewer. I’ve had a freshbooks and a waveapps account since 2011 and I send invoices to people paying on their own via freshbooks

I use Zoho Books very successfully. They do recurring billing including access for your clients through the client portal. The reports are awesome and it is quick and easy to reconcile.

We’ve been using Zoho Books for a few years and it does everything mentioned and integrates with all the other Zoho products.

Hi great post, we are production company based in the UK and a big fan of Elegant Themes. I would like to add another package to the mix

We have tried several of the cloud accounting packages but settled on http://www.freeagent.com.

This app makes accounting enjoyable. A sentence I never thought I would ever write. It has an easy to use clean interface, good for invoicing, payroll, and tax returns both personal and company. Bank reconciliation is automatic which saves hours and hours. You access it through a browser or mobile apps which makes keeping expenses receipts on the go and milage returns really easy. The quoting module is not quite up to speed yet but is functional. Improvements happen all the time and you are automatically upgraded.

The best bit is the support, when your stuck, both from a community of users and the company itself. I was not confident with accounts but now get quite smug when my returns are up to date.

As a customer if I refer a friend we both get 10% discount. So if you want to use my referrers discount code feel free.

Discount code: 4429s5v2 or use this Link: http://fre.ag/4429s5v2

I’ve recently changed from WaveApps to Pancake App for managing my finances, with the benefit of project management included. Very satisfied with Pancake App however WaveApps was a great free solution.

What an oversight! You missed the distruptive major game changer on the scene…while we’ve used Xero & Quickbooks in the past…we now use WAVE. It is easy, full featured accounting for free! http://WAVEAPPS.com Its robust, handles payroll in 3 clicks right from my iPhone (did I mention it’s free). Stripe for credit card payment is hooked up as well in a couple clicks and clients can pay right from the emailed invoice. It’s slick and really has everything you’ll need (ran multi million businesses)… you’ll be perfect on Wave (and save a bunch of cash). Can’t believe it was missed (it’s kinda like saying Google’s free Gmail should not be mentioned when talking about email software in a roundup of services). Feel free to PM me if you ever want to see how Wave works for our Agency.

It’s a great article, especially for those that are working in the freelance field, not many people have heard about one called QuickFile http://www.quickfile.co.uk . We have been using it for over three years, and in that time we have tried switching to some of the others but always stayed with QuickFile. It’s free, it’s cloud based, offers a full accountancy option, and invoices with many payment options.

If you are serious about accounting software, but don’t care to much for modern flat looks, fancy loading screens. Then I would suggest QuickFile, for simplicity and ease of use.

I’ve been using FreshBooks for about 4 months, and I really like it. Time tracking, basic ticketing system, beautiful invoices and online payment with FreshBooks or Stripe.

I also run a small onsite computer repair and training business, and the mobile invoicing is fantastic for this. The only thing it’s missing is an easy way to take credit cards through the app.

Yeah, good point Andrea. I’ve had a freshbooks and a waveapps account since 2011 and I send invoices to people paying on their own via freshbooks, but if we’re processing the credit card info while on the phone (or we’re setting up a recurring monthly billing), I use waveapps, so I can key in the information & store it in the stripe system to use later.

Everything else is synced with my bank, so there’s not a lot of extra work, but it would be nice to wave a magic wand and have all of the features in one system 🙂

Forget all of these and sign up for Wave Apps. Very complete. Very robust. Free.

https://www.waveapps.com/

I’d definitely add Wave (http://www.waveapps.com) to this list!

Wave accounting is very good and has all of the functionality I’m going to WordPress developer might need.

Great review. Xero and QuickBooks have low cost options. The Xero Starter package is $9.00 per month and additional information can be found at https://www.xero.com/us/pricing. The QuickBooks Self-Employed option is $9.99 per month and you can find details at http://quickbooks.intuit.com/self-employed.

Hi Tom Ewer , The 4 Best Accounting App Solutions for WordPress Developers.

http://www.iranroll.com/

Great post

I have been using the wp plugin “exchange” for all invoicing. It handles recurring payments and integrates with paypal, stripe and others. It allows clients to login and view all of their past invoices. Invoices get automatically marked as paid if done via credit card. It also offers an option for people to chose to pay by check. Once you receive the check you mark is as paid.

Anyone tried Slimvoice.co ?

I think it’s just for invoicing and not other accounting functions.

H

I’m also using 17Hats on the 30 day trial basis. You create Contacts and assign Projects to those contacts. There is a time tracker for hourly billing and templates for a Questionnaire, Contract and Invoices. So far, it looks good to me for only $12 per month. If you decide to try it, give my name as a referrer!

You should try wave app best software I’ve seen and it free

Great post as always!

I am a Xero user, couldn’t understand why you don’t like the payment tracking function there. You need a separate step of payment to enable the function of bank rec?

If you are looking for a free solution, I use this for all my billing (Computer repairs, web design etc) take a look at quickfile.co.uk

You can create quotations and convert them in to orders, your customers can also get their own login so they can review all their accounts.

I was previously using Sage, I feel this is a much easier system to use and there is so much customisation.

Is there any free option avaiable? Or any one time fee?

Check out Pancakeapp. I’ve been using it for 2 years so far and it gets better with each update.

I wrote a review of Pancakeapp

http://www.digitalcreativelab.co/products/simplify-invoicing-time-tracking-pancakeapp/

Thanks for the tips! Really helpful!

I am taking a look at waveapps and I am enjoying it

Thanks again 🙂

Hi Andre,

I use Pancakeapp [pancakeapp.com]. It’s awesome. Theres a one time fee but it’s self hosted and they’ll even set it up for you if you need them too.

@Andre the only good, free solution is Waveapps.com.

I’ve been using it since this year and it works well BUT you need to do your homework. Depending on how you use it and what your needs are it may not be a good fit. That’s true of most of them I guess.

It really helped me to sit down and make a list of “must-haves” and “like to have” when settling on an option.

This is a great overview of some of the accounting software options out there. I think that Wave Accounting (https://www.waveapps.com/) deserves a mention here too. It does everything the mentioned software options provide and more, and it has a great free plan!

I use WaveApps – unless you use their credit card payments (same rates as PayPal) or their Payroll system – it is FREE. It has a great phone app for scanning and loading receipts and the invoicing is great. Allows multi-company as well as separate personal profile and it connects to major banks for syncing transactions. Love it so far!

Tom nice article, as always superior content from the folks at ET, it would have saved me some footwork earlier in the year when I received notice my current version of QuickBooks(Pro2012) would no longer be supported, so I had to upgrade or move. I moved.

Although, I understand you were giving us all a great boil down of the top four, please allow me to give “honorable mention” to the solution I ended up choosing (don’t laugh); Godaddy Bookkeeping (formerly Outright). After using QB for over a decade I grew tired of the labor it took to maintain proper books, it was just more accounting than I needed. After reviewing the solutions above and a few more like Wave and lesser contenders I chose GD Bookkeeping because it was almost all automated and I wasn’t relegated to having to use the built in online processor, I could easily integrate PayPal, Dwolla, Stripe, etc. as well as have automated functions for my bank account as well right in the invoice the customer receives whereas previously and with many other solutions I’d have to manually create a PayPal invoice in addition to the QB invoice I had created. Now for about $59-$99 a year I am about 90% automated in accounting and bookkeeping using the aforementioned product and it’s accompanying mobile app.

I am also using Godaddy’s solution. But I got to it from looking into Outright (or maybe its outwrite) accounting software company that they bought. Their focus is taxation and have all the additional bells and whistles.

Shameless plug: If anyone is interested; I resell this product. Ping me 🙂

It is great. The only think additionally that I would love is an easier way to spread payments over multiple invoices (now you have to split manually).

Thanks,

T

I’ve been using waveapps for the last few years! I like it.

+1 for Waveapps

Waveapps accounting is great and syncs with your bank Acc

I use Pancakeapp for project management, estimates and invoicing. It’s self-hosted with amazing support. I highly recommend checking it out.

Great information on accounting app solutions! I’ve just recently began monetizing my blog so these apps will definitely come in handy when I start preparing for tax season.

Great article. One that I have been using is 17hats.com… it has it’s faults, but does offer quotes, invoicing and payments which has been fantastic for my business. Now I wish they had monthly billing. Do any of these offer that feature?

It would be worth those from the UK interested in a free alternative taking a look at Quickfile.co.uk I have been using it for a while and it does all of what I need and for free.

Simon

Agreed Lubos, Recurring billing is a pretty important feature for freelancers of all kinds.

It looks like 17hats has recurring billing in the horizon soon https://17hats.uservoice.com/forums/269781-general/suggestions/6600318-recurring-invoices

QuickBooks has it built in….http://intuit.com/blog/how-to-schedule-recurring-invoices/

including the option to email the customer automatically – decided on a case by case basis – something I really like, because some don’t really need the email reminder, some you’ll want to set up as recurring, but will add a few extra costs before it gets sent out, etc.

Xero does too…

http://www.dolmanbateman.com.au/7194/xero-create-recurring-invoice/

And two not listed in the blog (Wave – free Nutcache $14/mo) also have recurring invoicing connected with Stripe. I like this option best because the client credit card is stored securely on the stripe server, and I can go in and process the payments at the same time as sending out the recurring invoice.

apologies for geeking out on this topic – I was an accounting software consultant for over a decade.. I still love this topic 🙂

Hi Loralee – we are in the process of evaluating accounting software right now. Initially tried QBO but these were my bookkeepers complaints:

1. Difficulty converting existing QB files without lots of question marks that would take time to sort out.

2. Attachments didn’t seem to connect to attachment box.

3. Did not recognize memorized reports from QB when pulled into QBO (would require re-setup?)

4. Can’t drill down in invoice reports to see what was actually paid.

5. Accts are active, or you can delete. No “move to inactive” option which means historical data would be deleted if not kept active.

6. Same for classes.

7. Same w/ Items.

8. No toggling between info – either in a screen or it is closed. Apparently desktop version allows you to keep things open…?

I am not an accounting person but my current bookkeeper is transitioning out and we are bringing in a new one so now is a great time to switch if it makes sense. So here are my questions…

1. Are her complaints valid?

2. If not, which would you recommend between QBO and Xero (never heard of the latter – does it have staying power)?

3. If valid, is it still worth switching to SaaS vs. a desktop version?

Currently we have set up a desktop version with multi-user license, which is clunkier to use but will protect/maintain all the historical data we have. Would love to hear your thoughts on pros/cons re: shifting to the cloud. All of our team works remote so it sounds like a better option for the future…