Do you ever give any thought to the potential risks that your WordPress business might be facing?

If you’re like most small business owners, you probably don’t. Sure, every now and then a “what if?” thought pops into your head. But dealing with client inquiries, lead generation and a mountain of other issues often means that priorities are dictated by the degree of urgency.

And that’s the funny thing about business insurance – it’s rarely an urgent matter. Until, of course, it’s too late. Insurance is not an exciting topic. But unfortunately, it’s a topic that needs to be addressed because the future of your business and financial well-being might depend on it.

In this post, we’re going to outline the core issues that you should be considering when it comes to insurance for your WordPress business. We’ll also cover some of the different types of insurance you might want to think about obtaining.

To Insure or Not to Insure

One of the biggest challenges when it comes to running any small business is the sheer magnitude of issues you have to deal with. Between lead generation, onboarding new clients, technical problems and maybe even employees, something has to be put on the back-burner. Insurance is often one of those things.

The need for insurance is a catch 22. There are times when it makes absolute sense. But there are also times where it pays to think carefully before making a decision about whether or not it’s required.

The insurance industry will have you believing that you should insure for every eventuality. Just keep in mind that insurance companies are in the business of managing their risk as well as yours. They employ actuaries, who use complex mathematical formulas and statistics to predict the probability of a future event occurring.

If an insurance company pays out more than they bring in from premiums and investment returns, they are in a position of losing money. Any time you purchase insurance, you can be sure that the odds are slanted in the favour of the insurance company.

On the other hand, if you pay those premiums and end up needing the insurance, you’ll be grateful you have it. The secret here is giving some serious thought to how you, as a business owner want to manage your risk.

Luckily, there are many different types of insurance available. This means you’ll be able to look at your WordPress business and determine which areas you feel present an acceptable risk, and which areas require coverage.

Managing Your Risk Through Insurance

The vastness of the WordPress ecosystem means that there is also a wide variety of business types. We have developers, designers, hybrids, WordPress maintenance providers, content creators and conversion optimization specialists to name just a few.

The insurance needs of each one of these WordPress businesses is going to vary, which is why you need to use your judgement when making a decision. It’s also a good idea to get advice from an insurance broker and a lawyer as well.

If you’re working as a sole proprietor, you and your business are considered to be a single entity. That means that you personally are responsible. If a client feels that you’ve done something wrong and they pursue legal action, they can come after you and your personal assets.

As we jump in to take a closer look at the different types of business insurance, remember that each decision you make should come with a cost-benefit analysis. Very few people, especially small business owners, can afford to insure themselves against every possible scenario.

Health & Disability Insurance

When you insure your car, you’re often given the option of replacement insurance. If for some reason your car is destroyed, the insurance company will replace it. That’s important right? Nobody wants to lose their ability to get around town – it’s inconvenient.

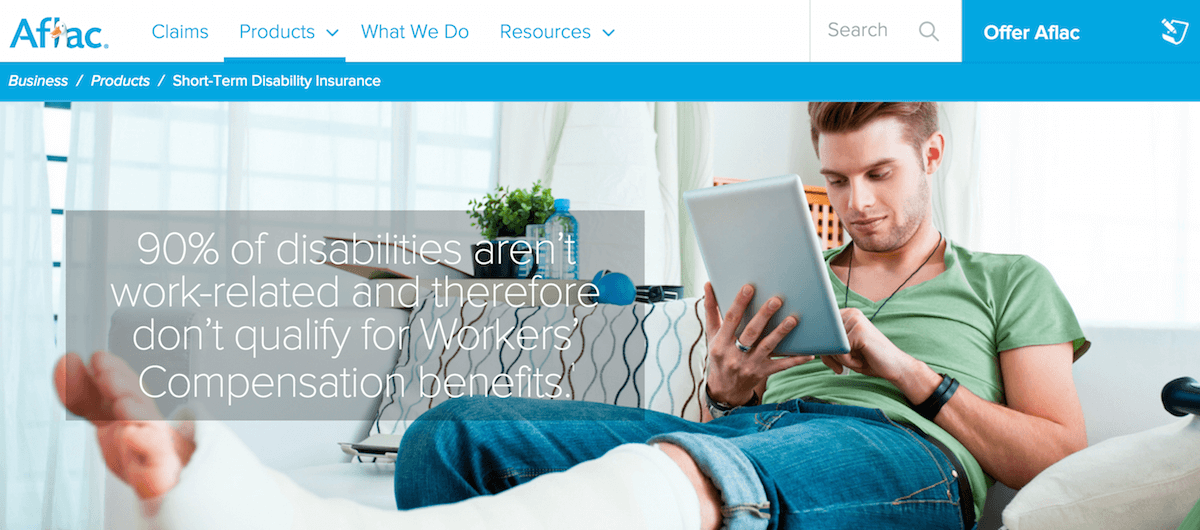

But what if something took away your ability to earn an income. Wouldn’t you find that to be inconvenient as well? You bet you would! Consider for a second, your earnings potential over the next five, 10 or 25 years. If you lost that potential, what would your liability look like and how might your life change? Would it affect your ability to provide for your family?

Most of us who are able-bodied and working with WordPress, rely on our fingers to type and or eyes to see the screen. What if you lost that ability? How long would it take to learn the skill again with your disability? I don’t point out these scenarios to scare you. I point them out because most business owners don’t think about them until it’s too late.

Health is always a concern. When you’re young and carefree, these things rarely cross your mind. But as you get older, the chances of health problems increase. At some point in time, it might be a good idea to insure your most important asset – yourself.

Typically, health insurance can be broken into a few different categories so you can pick and choose what you feel is most appropriate. These include:

- Critical Illness.

- Long-term care.

- Disability.

- Health and Dental.

While not all of these insurance types are critical to your business, they can be critical to your ability to earn an income from your business. And that is what it’s all about in the end – your continued ability to provide for yourself and your family.

Liability Insurance

Liability is always a concern for small business. As a WordPress professional working from your home or office, you need to be concerned about what clients or other people may feel you are liable for. Sometimes, unbeknownst to you, a client might have a reputation for being quick to head off to court.

For example, if you work from home and have a dog, what happens if a client comes to see you and is injured by your dog? It seems absurd, but these are the kinds of things that happen. Or what happens if a client trips down your stairs and says it was your fault?

Maybe those scenarios sound a little too far-fetched for your business? General liability insurance can cover the loss of data as well. If you’re building out a client’s website and you lose 2,500 lines of code the day before launch, what will that delay cost your client in lost revenue? Is it possible that you could be on the hook for damages?

Unfortunately, we live in a litigious society. General liability insurance can help to manage those risks caused by personal injury, property damage or bodily injury.

Errors and Omissions Insurance

Sometimes Errors and Omissions insurance (E&O) is also referred to as professional liability insurance. This type of insurance is designed to cover you in the event that you make a mistake – even if it’s caused by negligence or lack of judgement. Anytime you are providing professional service or advice, E&O insurance is a good idea.

We all know the importance of backing up a website before making any changes to a database, right? What if you were tasked with updating a client’s WordPress website to the latest version, or even cleaning up the overhead in their database, and you forgot to backup. What if their entire database was lost as a result of your mistake and their business went offline? What would your potential liability be in this situation?

Error and Omissions insurance is as much about protecting you as it is about protecting your client. If both parties are involved in signing a contract, it’s not uncommon for there to be an insurance requirement contained within it. E&O coverage can keep both parties at ease.

Partnership Insurance

Any time you bring a partner into your business, it’s a good idea to consider partnership insurance. If you’re running a small WordPress development agency and there are two or three partners involved, it’s important that no single partner is faced with the liabilities of the others.

This is one area where getting legal council is an especially good idea. There are various opinions as to the best way to structure insurance products between partners. Corporate insurance owned by the partnership must be weighed against a personal policy and, depending upon your jurisdiction, there can be tax, creditor and family legislation issues that need to be considered.

Another angle to be considered is what happens to your partner’s share of the business in the event of death? Would their spouse be your new partner? Or, would you have a buy/sell agreement in place with an appropriate insurance policy that gives you the ability to buy out their half of the company?

Workers Compensation Insurance

There are times when the government steps in and mandates the use of insurance. If you’ve managed to build yourself a small WordPress agency and are finally at the stage of bringing on a few employees, Workers Compensation Insurance is almost always a requirement.

Depending upon your location, you may be required to purchase a Workers Compensation policy from an insurance company or in some cases, there will be a government body that is responsible for administering the coverage.

In most situations, if you don’t have employees you are not required to maintain workers compensation insurance. But just because it’s optional doesn’t mean it’s not worth looking into.

You should also pay close attention to the laws in your specific area regarding contractors. You might find that you are responsible for that casual SEO contractor because she’s uninsured and performing work for your company.

Wrap-Up

The primary purpose of this article was to get you thinking about where your potential liabilities might exist and what types of insurance you might give some consideration to.

While it’s possible to insure against most risks and liabilities, it’s not always affordable. Depending upon what type of work you’re doing with WordPress and in what capacity, you’ll find that your insurance needs will change.

Before making any decisions regarding insurance, it’s a good idea to get opinions from more than one source. Insurance can get expensive rather quickly so it’s often a case of finding an appropriate balance. Just remember that the day you really need it, the cost will seem relatively inexpensive.

If you currently maintain any form of insurance, how did you decide what was most important for your WordPress business?

Image Credit: Stmool / Shutterstock.com

Hi Tom Ewer,

Really very informative article. You summed up everything on one page/post. I was really for such topics to find out that what and how should I write. All problems solved courtesy Tom Ewer. Thanks

While these posts are always helpful I really wish you would reach out to an experienced broker or industry knowledgeable person to write these posts when it comes to insurance. There are to many intricacies to insurance that people just won’t know. And this is from a guy who managed insurance programs for large Fortune 500 companies, ran captive insurance companies and even to this day is working with a Cyber liability insurance company on a project right now.

Unfortunately, insurance is all about definitions and exclusions and most people (and half the insurance brokers) don’t understand what they mean. In fact, Neil Patel did a great article on what he did wrong with his insurance, and what it meant to him and his company. http://www.quicksprout.com/2014/12/01/what-i-learned-from-fighting-a-12-month-lawsuit/

This is really a very interesting topic Tom,

Funny enough, I’ve never read about the importance of insuring a WordPress blog.

From all the points you made here, its really very important to register for a good insurance firm that can take good care of your blog.

But what is usually confusing to me is…. What if you ended up paying all the premiums and eventually your blog never ran Into any sought of problem, will the company wait for you?

Thanks for sharing

Thanks for the tips. I hadn’t considered E&O insurance. A lawyer friend says that now that I’m creating sites for bigger clients, I should consider incorporating. It would be great if someone would write an article about that!!

Hi, thanks for this interesting article.

Community, what company do you suggests for startup in web hosting especially for wordpress website, base in Canada, if we want to have one that cover most of theses liabilitie?

Thanks a lot.

The availability of insurance companies catering to this new digital kind of business is hard to find specially in third world countries where a substantial number of wordpress blog owners are located. Insurance in these regions cater to the traditional form of insurance like life and health insurance.

The business insurance mentioned above is more appropriate to a tangible traditional business like a physical shop.

WordPress professionals small business insurance!!!! I have never think about it. Really important to have insurance backup.

Awesome collections of Free and Premium WordPress Themes and Plugins. Also lots of special deals and quality service offers from WordPress Experts.

“…if you lose 2,500 lines of code the day before launch” you are negligent. A reasonable and prudent designer/developer or even a remotely professional person getting paid for building a website would back up the code and probably implement some system of version control. Most GL and some E&O policies exclude negligent acts. It’s important to read the policy.

I’m surprised that DOS attacks or hacks– and other cyber attacks wasn’t mentioned. Cyber attacks can be covered by endorsement or a stand alone policy–and is probably more important than any of the others mentioned. The likelihood of a site getting attacked is quite high.

If you get sued and you don’t have insurance, you are on your own to pay the litigation costs–even if you win. A good insurance policy will cover the legal fees involved if you ever get sued.

Hold harmless agreements don’t usually stand up in court. But, if you don’t have insurance and you land in court, hopefully you have deep pockets to pay the legal fees and associated court costs to defend that hold harmless agreement.

There are several outstanding policies to cover small development firms. Don’t go with any carrier with less than an A+ rating. And, if you call an agent and they don’t know what that is, hang up until your find a professional broker or agent who does.

I agree. Cyber attacks are the priority risk and then all others.

We have Cyber Insurance which covers our website lead generation businesses. It’s worth looking at your country equivalent. We’re in Australia.

SSL is a good addition, but not only for preventative site security. Having SSL and Wordfence installed and running onsite should help to keep your insurance risk low which in some cases could keep the annual premiums low too.

I wish you would have included a few places on where to look for insurance of the various types here. Now that you’ve established need, it’d be nice to point someone in a particular direction.

Just my 2 cents….

Here’s a way to avoid liability insurance. Add an indemnity clause to your contract with your client if you are that concerned about the liabilities you may face. Either the client signs it or you walk away.

As well as all of the above, when you get insurance for WordPress or any web related business make sure it covers Virus and Malware transmission. (My insurance covers this

A lot of insurance companies will exclude these and not cover you for accidentally infecting a client’s systems, website or server. Read the fine print!!!

Hi Simon, Nice point. Need to include it as current days Virus and Malware transmission is common issue. We never know about it. If its client’s fault or if there is any server side issue, but at last it will come to developer.