Although PayPal is one of the most popular online payment platforms, having alternatives available is always smart. Customers who don’t already have an account likely won’t want to set one up to make a single purchase, and international shoppers may struggle with this particular gateway.

Fortunately, WordPress is so popular that most major payment processors offer easy options for integration. They do this through many different payment plugins on the market. There are several quality PayPal alternatives you can add to your website with relative ease. In this article, we’ll go over three of the best.

Let’s get to it!

Subscribe To Our Youtube Channel

Why You Should Provide PayPal Alternatives on Your Website

Whether you’re running a standard e-commerce store, selling your services as a freelancer, or booking paid appointments with WordPress plugins, you need a way to secure customers’ payment information. PayPal is a popular platform for this task. It’s fairly well-known and trusted, which makes it an ideal tool in many situations.

However, PayPal is far from the only payment gateway option you have. Offering alternatives to your customers may help increase your sales by streamlining your checkout process for some people.

For instance, if a customer doesn’t have an existing PayPal account, they may consider it easier to abandon your site and buy what they need from a competitor than to sign up for another online service. Once a shopper clicks on your Checkout button, you don’t want anything to slow them down and give them a chance to walk away.

Plus, for many countries, PayPal isn’t the preferred payment gateway. You may lose out on international customers if you don’t provide alternatives they can use to complete their purchases.

Studies show that offering multiple payment gateway options can increase online sales. After all, it enables your users to choose which processor they feel more comfortable with. That means even if you’re working in a market where PayPal is king, offering an extra alternative or two on your website can’t hurt.

3 Best PayPal Alternatives for WordPress Users

There are many fantastic PayPal alternatives to choose from for your website. However, not every payment gateway works with WordPress as easily as it should. For this list, we only focused on options that provide multiple integration methods with our favorite Content Management System (CMS).

Additionally, we avoided discussing PayPal alternatives that make little sense for most small businesses, such as cryptocurrency. The options below don’t require you to learn whole new ways of collecting customers’ payments – just new interfaces.

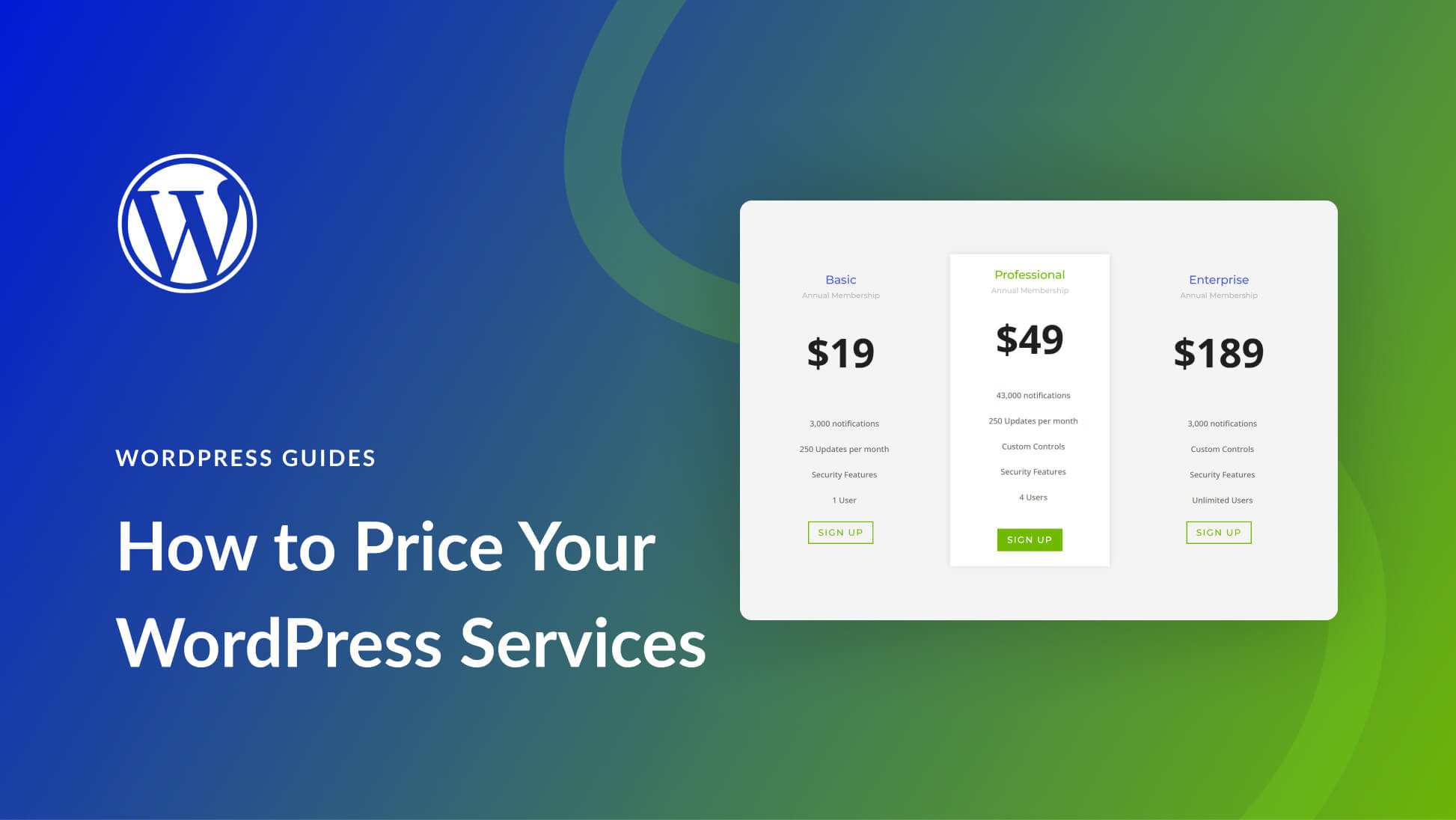

Finally, here’s a quick breakdown of how much PayPal charges in merchant fees for comparison:

- Standard US merchant rates: $0.30 + 2.9 percent of each transaction.

- High-volume merchant rates: 1.9 percent of each transaction.

- International sales: 4.4 percent of each transaction + a flat fee dependent on the incoming currency.

To get the lower rate, you need to apply for a special PayPal program. Keep these numbers in mind as we go over some top PayPal alternatives.

1. Stripe

Stripe is one of the biggest PayPal competitors in the US market and also has a notable presence in several other countries around the world. It charges merchants $0.30 + 2.9 percent for each transaction, matching PayPal’s base rates.

However, Stripe is much friendlier for global sellers. Its international transaction fee is just 3.9 percent compared to PayPal’s 4.4 percent, although there is a one percent currency conversion fee.

It also offers local payment options so your customers can shop using the methods that make them most comfortable. If you have a significant audience in one of the 37 countries where it’s available, Stripe is a decent option for your website.

Beyond that, Stripe also offers multiple integration methods for WordPress, including:

- Stripe Payments: With this plugin, you can accept credit card payments via Stripe and provide links to digital downloads for successful transactions.

- Stripe for WooCommerce: With this plugin, you can process Google Pay and Apple Pay payments for your store on top of credit card transactions, all through Stripe.

Out of the box, WooCommerce provides integration with Stripe using an official extension as well. That option is easier to set up, but it doesn’t offer as much control over the checkout process as Stripe for WooCommerce.

Fees: $0.30 + 2.9 percent per transaction | More Information

2. 2Checkout

If you’re looking for a payment gateway that offers as much coverage as possible throughout the globe, 2Checkout may be for you. It’s available in over 200 countries and supports dozens of payment methods that vary from region to region.

As far as fees go, 2Checkout offers different pricing tiers. Their fees start at $0.35 + 3.5 percent per transaction. However, for users that only sell digital products and services, fees jump up to $0.60 + 6 percent per transaction – significantly more expensive than PayPal or Stripe.

If you want to integrate 2Checkout with WordPress, there are several plugins you can use to get the job done, including:

- Easy Digital Downloads: This plugin enables you to sell digital products online using a system that’s more straightforward than a full WooCommerce setup. One of the payment processors it supports is 2Checkout.

- Paid Membership Pro: If you want to sell subscription-based services, this plugin enables you to do it. It supports 2Checkout payments as well as PayPal and Stripe.

Despite its near-global availability, 2Checkout is perhaps not the most attractive option for freelancers or agencies due to its high fees. However, if you’re operating from a country where PayPal isn’t available, 2Checkout might be the best alternative due its wide reach.

Fees: $0.35 + 3.5 percent per transaction | More Information

Authorize.Net provides a simple way for you to enable multiple payment options on your site simultaneously. It’s a well-known payment processor and charges the industry standard of $0.30 + 2.9 percent per transaction with its basic all-in-one merchant plan.

The most significant advantage of using Authorize.Net is that it supports multiple payment types beyond credit cards. Those include PayPal, e-checks, Apple Pay, and more. If you want to accept PayPal payments without using the platform directly, Authorize.Net can help.

There are several WordPress plugins you can use to integrate this gateway with your site, including a few we’ve already mentioned:

- Easy Digital Downloads: E-commerce for vendors of digital products.

- Paid Memberships Pro: Supports Authorize.net credit card payments for subscriptions.

- Authorize.Net Payment Gateway for WooCommerce: If you want to sell digital goods or services via WooCommerce, you can integrate Authorize.net payments using this extension.

The major downside to using Authorize.Net is that it only supports a handful of currencies for countries in North America, Europe, and Australia. If your website has a significant customer base in other regions, you’ll need at least one other payment gateway in addition to this one.

Fees: $0.30 + 2.9 percent per transaction | More Information

Conclusion

When it comes to payment gateways, PayPal is one of the biggest names in the market. However, there are plenty of PayPal alternatives that you can easily integrate with WordPress to give your shoppers more options at checkout. With the right plugins, you can enable several of them simultaneously.

Here’s our list of top suggestions for PayPal alternatives you can use with WordPress:

- Stripe: Out of all PayPal alternatives, Stripe is by far the easiest to integrate with WordPress and the most popular.

- 2Checkout: This payment gateway is an excellent option if you want around-the-world coverage, although its fees are somewhat high.

- Authorize.Net: Although it’s only available in select countries, this gateway makes up for it by providing multiple payment methods, including PayPal.

Do you have any questions about how to choose the right payment gateway for your online business? Let’s go over them in the comments section below!

Article thumbnail image by Belozersky / shutterstock.com

No this is exactly the kind of insight and comparison I was looking for just to have a backup for paypal would be great for me as I have heard about too many account freezes going on. On others accounts some as little as 10k revenue like that to me is very worrying so I need backups atleast 2, thanks for this.

Hello Miraz! I’m happy you found the information you were looking for. It’s definitely a good idea not to put all your eggs in one nest when it comes to payment processors, particularly if your business does a lot of sales.

recently I have started using authorize.net for my business. Service which serves best in the industry I guess

I personally love STRIPE and have been using them for a year now. I have has zero problems with them. I’m glad to see they made your list.

Hello Denver! I’m glad Stripe is working out well for you, it’s definitely one of the best options if it’s available in your region.

Veteran Nonprofit organization, Event tickets, Membership, and T-shirts. Authorize.net sounds about right? Can you put the cost on the contributor?

Hello John! Authorize.net shouldn’t give you any problems for event tickets, recurring memberships, and selling t-shirts, but I’m not sure if it would work for a nonprofit organization. I think they may only offer support for nonprofits through their enterprise solution plans, which are only an option for organizations that bring in big numbers.

Hello,

I’d recommend to try Paddle payment gateway and WPSmartPay plugin that integrate Paddle to EDD and WooCommerce seamlessly.

Lots of WP business are switching to Paddle these days.

Hello Parvez! We’re not familiar with Paddle, but I’ll check it out and see what all the fuss is about 🙂

I think you have missed a couple of key players here: Amazon and Square. We have used Square very successfully for about 18 months. And Amazon has a growing share and proven ability to penetrate when they choose.

Based on information from Datanyze respective market shares are:

PayPal 58%

Stripe 16%

Amazon Pay 4%

Square 3%

PayPal is declining, and when we attempted to use the service back when they were a nightmare to deal with. Square is simple, quick to set up, and works well.

Hi Tim! We tend to agree on the grounds of market share alone, but we wanted to focus solely on options that provide easy integration with WordPress rather than make this a list of payment processors in general. You can integrate Amazon Payments and Square with WordPress, but the options are much more limited than with other gateways.

If your product is digital, you should know that many payment processors have rules against accepting payments for those products. I believe Authorize is one of them that does not allow payments for products that are digital. (They may have changed… it’s been years. But, I know I had issues with one of them.)

Hi Jennifer! Fortunately, most payment gateways realized that not providing support for digital goods was a losing battle. Authorize.net itself works with Easy Digital Downloads, to give you an example. Dealing with chargebacks for digital goods is still a challenge, though.

Paypal have a strong way of counterchecking fraudulent chargebacks.

If you dont use or have not an active Paypal account, there is a big change that you are kicked out at Paypal, mostly for undisputed or fraudulent chargebacks.

Payment is one thing but secure payment as seller is King

If a buyer have no good Paypal trackrecord, he or she can only pay 100% in advance via bank transfer or I wish my opponents good luck with that buyer.

I switched from PayPal to Stripe for my customers. For recurring charges I use their subscription option, which I’ve customized and placed on my website. This automatically charges the customer’s card until the customer cancels. Unfortunately, when someone’s card expires or is hacked and replaced, there is NO notification to me from Stripe that the payment failed. I only get notified when a payment succeeds. Therefore, finding out who is missing is way more work than it should be. Stripe tells me it’s possible to enable notifications of failed subscription payments if you use an API but I don’t know how to do that. Could someone point me in the right direction, please?

Hi PseudoGeek! Have you tried using webhooks? There’s a section of their documentation that deals with failed subscription notifications: https://stripe.com/docs/billing/subscriptions/webhooks